As soon as accepted for an unsecured loan, you are going to make regular payments to pay it again in full, in addition fascination. The loan phrases and desire rate differ dependant on the lender plus your credit history.

We’ll question concerns to slim down your lender and amount eligibility. Get genuine charges, not estimates.

It’s value trying to keep in your mind that the top loan conditions ordinarily go only to those with superb credit score. If a lender advertises fees setting up in the single digits, test to determine their entire selection of accessible prices and costs to get a greater feeling in their offerings.

Remember that some lenders might have more stringent necessities to make sure that borrowers can repay their loans, although.

Every single lender has its own specifications for loan approval. On the other hand, most house loan lenders need a financial debt-to-profits ratio of no more than forty three% plus a credit score score of no less than 580 depending on the style of mortgage loan.

When you’re intending to consider out a $1,500 loan to consolidate debt, fund An important buy or advance A different economic target, it’s imperative that you weigh your options.

Prequalified rates are determined by the information you give plus a delicate credit score inquiry. Obtaining prequalified prices does not promise the Lender will lengthen you a suggestion of credit. You aren't yet accepted for a loan or a particular level.

Could it be easy to acquire a $1,400 loan? The ease of acquiring a $1,400 loan relies on your credit score and a lender’s distinct approval prerequisites. Borrowers with increased credit history scores are more likely to be authorized for the broader array of loans and with much better phrases. But particular lenders industry to folks whose credit rating is over the lessen end in the spectrum, which will take some guesswork out of the applying procedure.

Prequalified costs are dependant on the information you present plus a gentle credit history inquiry. Getting prequalified premiums won't ensure which the Lender will extend you an offer of credit score. You are not nevertheless permitted for your loan or a specific amount.

You may additionally want to possess a home inspector Consider the property before you decide to shift ahead with the purchase. Some home loans, for example FHA loans, call for the borrower to secure a click here house inspection.

Lenders also consider the loan-to-value ratio (LTV) when determining household loan fees. This amount represents the quantity you will borrow in comparison to the worth from the residence. The LTV ought to be fewer than 80% for that least expensive home finance loan rates.

Checking out this loan table, it's easy to discover how refinancing or having to pay off your mortgage loan early can really have an effect on the payments of your one.4k loan. Insert in taxes, insurance plan, and maintenance prices to obtain a clearer picture of General property ownership expenditures.

Prequalified premiums are based upon the information you supply as well as a smooth credit history inquiry. Acquiring prequalified charges isn't going to guarantee the Lender will lengthen you an offer of credit history. You are not nonetheless accepted for just a loan or a certain fee.

We’ll inquire inquiries to narrow down your lender and rate eligibility. Get actual charges, not estimates.

Luke Perry Then & Now!

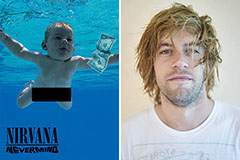

Luke Perry Then & Now! Spencer Elden Then & Now!

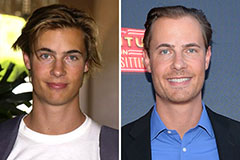

Spencer Elden Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!